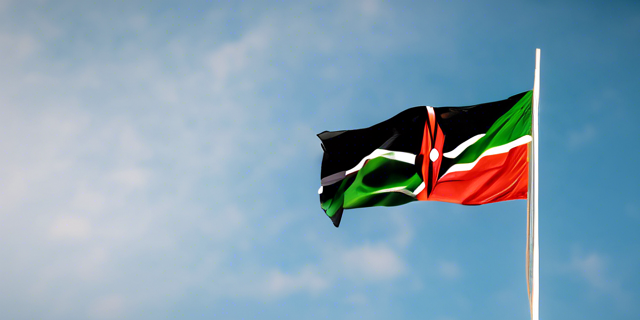

Laws any Foreigner planning to Invest in Kenya Should Know

Introduction

Kenya is emerging as one of Africa’s most dynamic economies, attracting foreign investors from across the globe. With a stable political environment and strategic location in East Africa, Kenya offers numerous opportunities in sectors like technology, agriculture, and tourism. However, navigating the legal landscape is crucial for any foreign investor looking to establish a foothold in the country. This guide outlines the essential Kenyan laws every foreign investor should know to ensure compliance and successful business operations.

Business Registration and Licensing

Types of Business Entities in Kenya

When setting up a business in Kenya, choosing the right type of business entity is the first critical step. The most common types include:

- Sole Proprietorships: Ideal for small businesses with single ownership.

- Partnerships: Suitable for businesses owned by two or more individuals who share profits and liabilities.

- Limited Liability Companies (LLCs): The most preferred choice for larger enterprises, offering protection against personal liability.

Requirements for Registering a Business

Registering a business in Kenya involves several steps, including name reservation, obtaining a PIN certificate from the Kenya Revenue Authority (KRA), and registering with the National Social Security Fund (NSSF) and the National Hospital Insurance Fund (NHIF). Key documents required include:

- A completed application form (BN/2)

- A copy of the proposed business name

- Identification documents for the owners

Licensing Requirements

Depending on the nature of your business, specific licenses may be required. For example, a general trading license is needed for retail businesses, while manufacturers must obtain an industrial license. The process typically involves:

- Application Submission: Provide necessary documentation to the relevant licensing authority.

- Inspection: A compliance inspection may be conducted.

- Approval: Upon meeting all criteria, the license is issued.

Taxation Laws

Overview of Taxation in Kenya

Kenya’s tax regime is managed by the Kenya Revenue Authority (KRA). The key taxes include:

- Income Tax: Levied on both individuals and businesses.

- Value-Added Tax (VAT): Applied to the sale of goods and services, currently at 16%.

Corporate Tax Rates and Compliance

Corporate tax rates in Kenya are 30% for resident companies and 37.5% for non-resident companies. Compliance involves:

- Filing annual returns

- Paying taxes on a quarterly basis

- Keeping accurate financial records

Double Taxation Agreements

Kenya has signed Double Taxation Agreements (DTAs) with several countries to prevent double taxation of income. These agreements are beneficial for foreign investors as they help avoid being taxed twice on the same income in both Kenya and their home country. Countries with DTAs with Kenya include the UK, Germany, and India.

Employment and Labor Laws

Hiring Local vs. Foreign Employees

The Employment Act in Kenya regulates the hiring of both local and foreign employees. For expatriates, work permits are mandatory and are categorized under different classes depending on the nature of the employment.

Employee Rights and Protections

Kenyan labor laws are designed to protect employee rights, including:

- Minimum Wage: Set by the government and varies by region and sector.

- Working Hours: The standard workweek is 48 hours, with provisions for overtime pay.

- Leave Entitlements: Employees are entitled to annual leave, sick leave, and maternity/paternity leave.

- Termination of Employment: Must be done in accordance with the law, with just cause and proper notice.

Land and Property Ownership Laws

Land Ownership for Foreigners

Kenya has specific regulations regarding land ownership by foreigners. While non-citizens are restricted from owning freehold land, they can acquire leasehold land for up to 99 years. It’s important for investors to understand these restrictions and explore leasing options.

Land Use and Zoning Regulations

Investors must adhere to zoning regulations that dictate the permitted use of land in different areas. This is especially crucial for businesses involved in manufacturing, agriculture, or real estate development. Understanding these regulations helps in selecting appropriate land and avoiding legal issues.

Intellectual Property Laws

Protection of Trademarks, Patents, and Copyrights

Intellectual property (IP) protection is vital for businesses to safeguard their innovations and brand identity. Kenya’s IP laws are governed by the Kenya Industrial Property Institute (KIPI). The process involves:

- Trademark Registration: Protects brand names, logos, and symbols.

- Patent Registration: Secures rights for new inventions and innovations.

- Copyright Registration: Protects original works of authorship, including literature, music, and software.

Environmental and Regulatory Compliance

Environmental Impact Assessments (EIA)

Businesses operating in Kenya are required to conduct Environmental Impact Assessments (EIA) for projects that may affect the environment. This involves:

- Scoping: Identifying potential environmental impacts.

- Assessment: Conducting detailed studies to evaluate these impacts.

- Reporting: Submitting an Environmental Impact Assessment report to the National Environment Management Authority (NEMA).

Sector-Specific Regulatory Requirements

Different sectors in Kenya have specific regulatory requirements. For instance:

- Agriculture: Compliance with agricultural regulations and standards.

- Manufacturing: Adhering to industrial safety and environmental standards.

- Services: Meeting licensing and operational standards specific to the service industry.

Dispute Resolution and Legal Framework

Understanding the Kenyan Legal System

Kenya’s legal system is based on English common law and incorporates statutory law, case law, and customary law. Dispute resolution can be pursued through the courts, but alternative mechanisms like arbitration and mediation are also available and often encouraged for efficiency.

Conclusion

Investing in Kenya offers immense opportunities, but it’s essential for foreign investors to be well-versed with the local laws. From business registration and licensing to taxation, employment, and property ownership, understanding the legal landscape will help avoid pitfalls and ensure smooth business operations.

FAQs

What are the main types of business entities I can set up in Kenya?

- The main types are sole proprietorships, partnerships, and limited liability companies (LLCs).

2. How do I obtain a business license in Kenya?

- You need to apply through the relevant licensing authority, submit required documents, and undergo any necessary inspections.

3. Are there tax incentives for foreign investors in Kenya?

Yes, Kenya offers various tax incentives for foreign investors, especially in special economic zones (SEZs) and for businesses involved in manufacturing and export. These incentives include reduced corporate tax rates, VAT exemptions, and investment deductions.

4. What are the restrictions on land ownership for foreigners?

Foreigners in Kenya are not allowed to own freehold land but can lease land for a period of up to 99 years. These leases are subject to renewal and must adhere to Kenyan land laws and regulations.

5. How can I protect my intellectual property in Kenya?

To protect your intellectual property in Kenya, you should register your trademarks, patents, and copyrights with the Kenya Industrial Property Institute (KIPI). This will give you legal protection and the ability to enforce your rights in case of infringement.